The No BS Growth and Income Portfolio

$499.00 / year

John Del Vecchio’s

The No BS Growth and Income Portfolio

Each month, John sends his subscribers the latest portfolio in his No BS portfolio. The system aims to outperform the S&P500 as well as the dividend index. John accomplishes this by using his Forensic Accounting Stock Tracker (FAST) analysis to identify the high-dividend paying stocks that are poised to break out. He uses the same FAST analysis to flag high-dividend stocks that are likely to cut their dividends or are using accounting tricks to pump up their numbers. This allows John to focus on stocks growing their businesses and to kick the others to the curb, leaving with the top 10 dividend-paying stocks.

John does all of this so that you don’t have to.

Instead of wading numbers, John sends an email every Monday to subscribers outlining what, if any, action to take. Sometimes subscribers will be told to sell a holding or two and replace them. Many weeks subscribers are told that there’s no change. The goal here is to offer a growth and income plan so simple that subscribers can handle all the changes in a week in a matter of minutes.

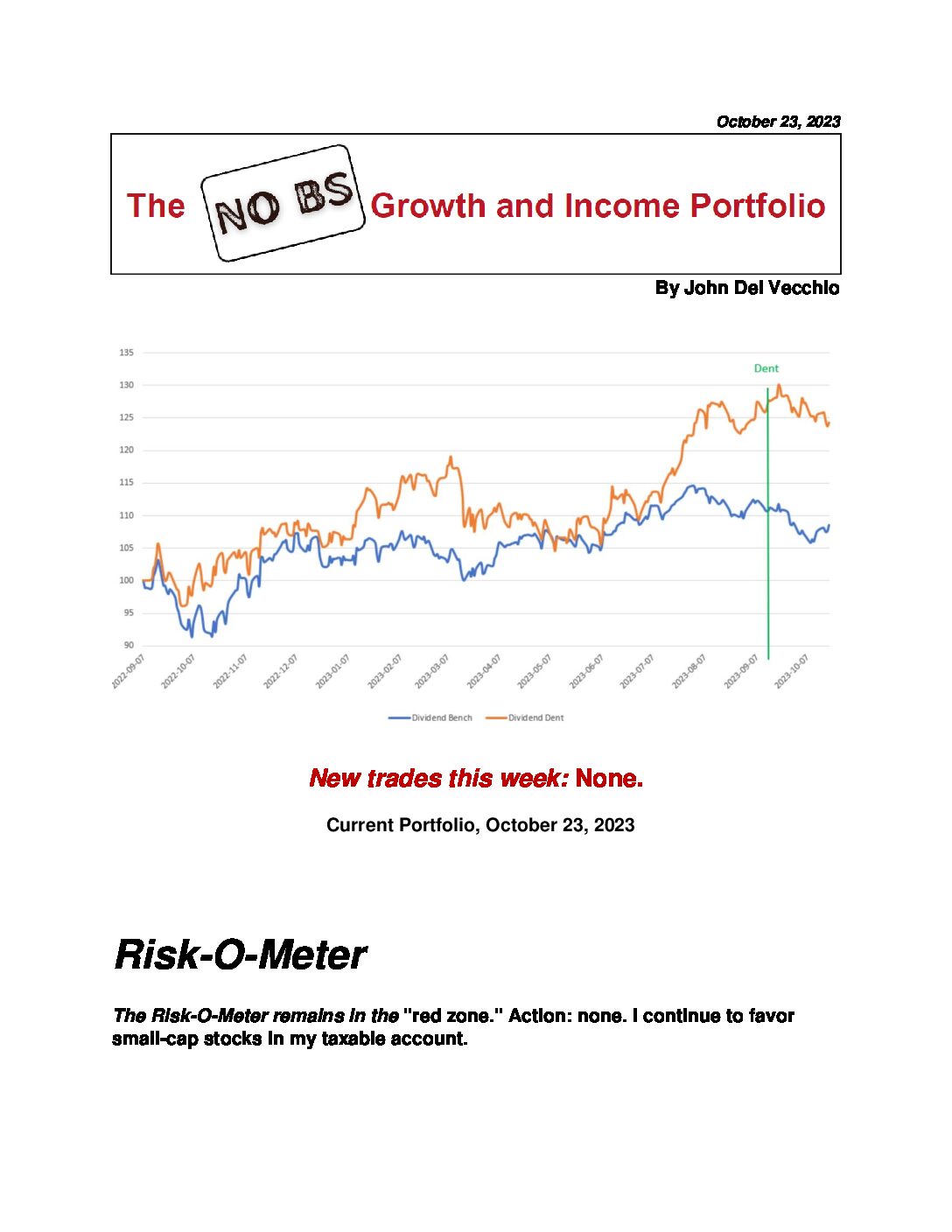

As a bonus, he provides his proprietary Risk-O-Meter, based on his three decades of market experience; it can show you quickly the opportunities and risks of investing in the markets. Factors like greed, fear, strength or weakness of stocks, trends in the fixed-income markets, and volatility combine in one simple gauge that tells you when it’s time to act.

If you can read the gas gauge on your car’s dashboard, you can understand the Risk-O-Meter.

The Risk-O-Meter is without a doubt the best tool he has for timing investments into his taxable account. In testing, most market gains (the majority) were achieved when the Risk-O-Meter gave the green light to “back up the truck” and buy stocks. Using the Risk-O-Meter more than tripled the average stock performance with less than half of the risk!

But don’t forget that the No BS portfolio is meant to be fully invested. The Risk-O-Meter allows you to see potential times of danger and opportunity across financial landscape, but if you try to time the No BS portfolio, it will probably lead more to mediocrity than anywhere else.

HSD Publishing

Creating financial Futures

Contact Us

15016 Mountain Creek Trail

Frisco, Texas 77573

281-721-4569

[email protected]